Are you a credit repair company struggling to keep up with disputes, updates, and letters? Kaironeek Financial provides backend credit repair processing so you can focus on growing your business, not writing letters. You collect the client’s documents, upload them to us, and we’ll do the heavy lifting. You stay in control of your client relationship — we never contact your customers directly. This is not a white-label service. We work exclusively with your company behind the scenes. You get the updates, you give them to your client.

.png)

Who This Is For

- Independent credit repair professionals

- Growing credit repair businesses

- Loan officers, car dealers, mortgage brokers, or real estate agents with clients who need better credit

- Tax professionals who added credit repair services

- Anyone with clients but no time for backend processing

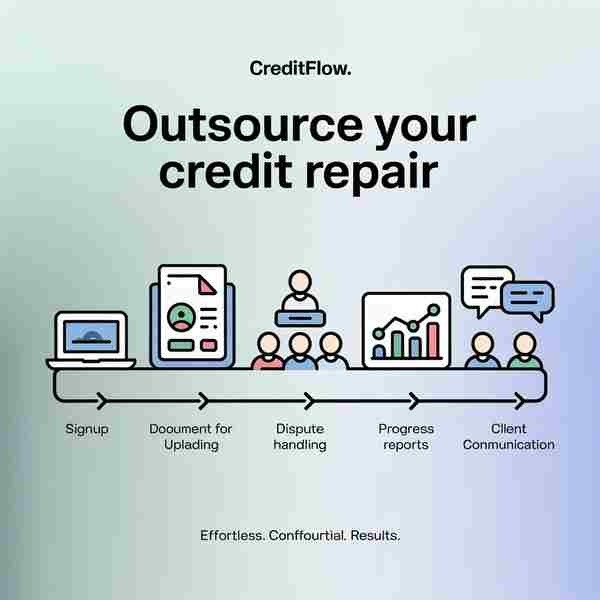

How It Works

- Sign up as an outsourcing partner

- Submit your clients’ credit report and documents

- We handle disputes and process updates

- You get a monthly progress report from us

- You remain your client’s only point of contact

What We Do

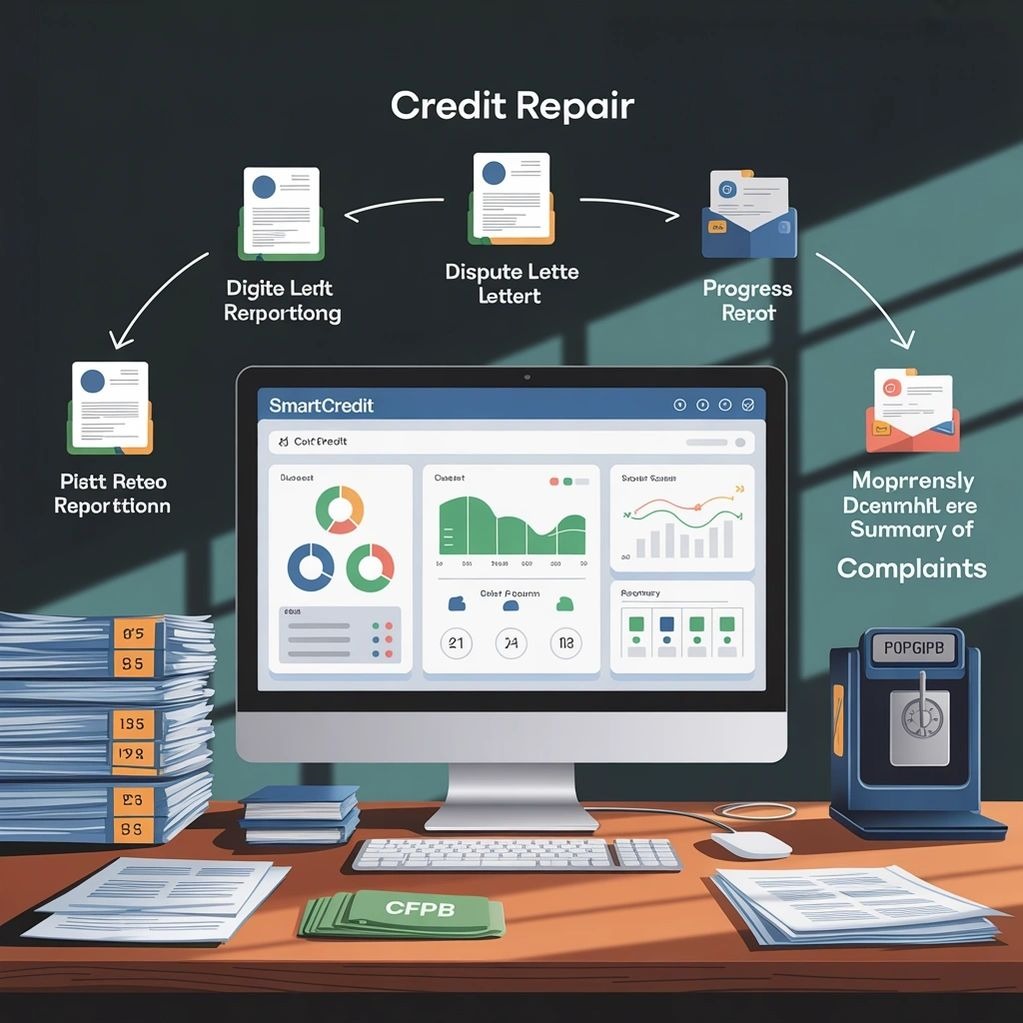

- Pull and analyze credit reports (SmartCredit preferred)

- Draft and send dispute letters each month

- Address unverifiable items and inaccurate accounts

- Monitor for responses and track updates

- Provide monthly summaries for you to share with your client

- Optional: Draft CFPB complaints if necessary

What You Get

- Full backend processing by legal and compliance-minded professionals

- No templates or DIY letters — we handle it all

- Secure file submission system

- Dedicated updates for every client

- No contact with your clients (you control the relationship)

Ready to Let Us Handle the Work?

Click below to complete the partner onboarding form and upload your first batch of clients. Let’s grow your business together.